Japanese multinational investment holding company SoftBank announced on Tuesday that it will invest $2 billion into struggling American chipmaker Intel. The investment is reportedly equal to about 2% of the US company, which will make SoftBank the fifth-biggest shareholder. According to a joint statement by the two firms, SoftBank will pay $23 per share of Intel common stock. It’s a major boost for Lip-Bu Tan, who was made CEO of the once-iconic chip manufacturer in March.

SoftBank and Intel Leaders Both Pleased About the Relationship

“We are very pleased to deepen our relationship with SoftBank,” said Tan. The former CEO of Cadence Design Systems called the Japanese conglomerate “a company that’s at the forefront of so many areas of emerging technology and innovation.” He added that he has worked closely with Masayoshi Son, the chairman and CEO of SoftBank, for many years, and that he appreciates “the confidence he has placed in Intel with this investment.”

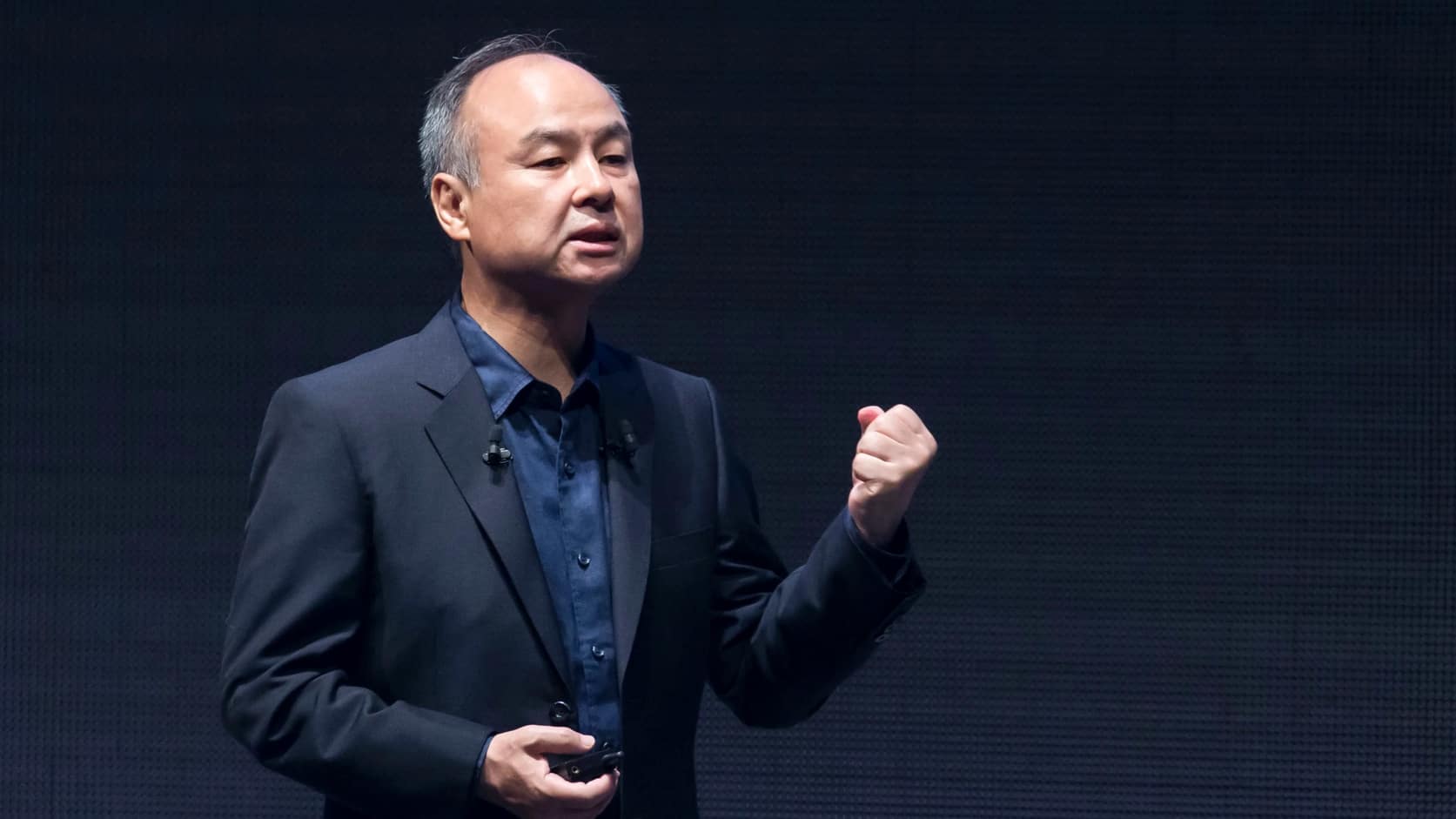

Son, meanwhile, said semiconductors were “the foundation of every industry.” Japan’s second-richest man, who last December announced a $100 billion investment in the US over the next four years, described Intel as “a trusted leader in innovation.” He added, “This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role.”

A crucial company in the foundation of Silicon Valley, Intel was historically a dominant force in the semiconductor industry. Once so powerful, it allegedly wanted to purchase Nvidia for $20 billion two decades ago. Since then, Nvidia has surged past its competitors, and, earlier this year, became the first publicly traded company worth $4 trillion. Intel, on the other hand, has fallen far behind, having failed to properly develop competitive GPU technology and having missed out on the AI boom.

Trump Administration Considers 10% Stake in Intel

In addition to SoftBank’s investment, the Trump administration is also working on a deal that could see the US government take a 10% stake in Intel. Speaking to CNBC on Tuesday, US Treasury Secretary Scott Bessent said, “The last thing we’re going to do is take a stake and then try to drum up business. The stake would be a conversion of the grants and maybe increase the investment into Intel to help stabilize the company for chip production here in the US. There’s no talk of trying to force companies to buy from Intel.”