by Dr. Greg Story

Currency movements can be highly irritating. You travel to Italy paying ¥172 to the Euro (like I did last summer) or you travel at ¥120 to the Euro and both life and credit card hills look entirely different.

Maybe you need to make the loan payments on that real estate property you are renting out al home and you realize you should have converted more yen when the rate was good. Foreign exchange (FX) volatility can be frustrating. What can you do?

If the strong yen is exhibiting any signs of uniqueness then it may be time to buy, on the basis the yen will reverse course in the future. Read what the experts are predicting. Many say the expanding US Government deficit will keep the US dollar weak. Look at linkages. There was a terrific graph in the Nikkei News recently that plotted the yen and the Nikkei on the same graph. They are clearly moving in opposite directions al the moment. There is a hint!

If you tie your yen up for a day at a time in an ‘at call’ account, you will be lucky if you are gelling 0.04 percent interest. If you tie it up for a year, some local hanks are offering 1.1 percent. Even if you tie it up for a year, you will only get the interest and there is no possibility of capital gain.

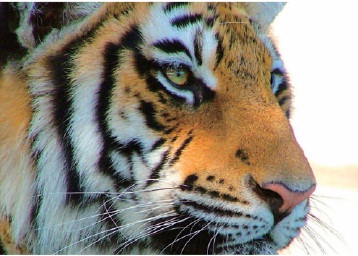

If you want to mount the FX tiger, you can move some of your hard won cash into higher interest yielding currencies like the Aussie or Kiwi.

Say, you want to buy a one year term deposit of A$10.000 and the exchange rate is ¥60, then you will need to hand over ¥600,000. If, at the end of the year, the yen has weakened and it is up to Y90 to the dollar. Your AS10.000, plus your annual interest return of, say, four percent (A$400) converts back to ¥936,000. You just made ¥336,000 interest and capital gain on your ¥600,000 investment. In this simple example, that is a 56 percent return per annum.

Sounds pretty good, but don’t forget you will need to deduct FX fees for the conversions into Aussie and then back again into yen (this could be significant depending on what your bank charges), plus pay tax on the capital gain.

Don’t forget that return and risk go together. The yen may not cooperate with our grand plan and in fact may strengthen. Bother! In this case you will definitely lose money—possibly both the interest and some of your original investment.

In this example, you can always leave it in Aussie or Kiwi and take no loss from converting it back to yen and continue to enjoy comparatively better interest rates until the yen starts moving in the direction you prefer. You need to be able to afford to leave it there and allow your losses to remain paper losses until things get better. Sounds just like my share portfolio!

Tiger rides anyone?

Dr. Greg Story is the country head of National Australia Bank. For more information, see www.nabasia.com or call 03-3241-2144.